how to pay meal tax in mass

Generally food products people commonly think of as. The maximum tax that can be enacted on meals in.

Massachusetts Sales Use Tax Guide Avalara

The local meals tax does not increase restaurant bills significantly.

. In Massachusetts there is a 625 sales tax on meals. The maximum tax that can be enacted on meals in. In May 2016 the Annual Town Meeting adopted Massachusetts General Law Chapter 64L section 2 a which established a local meals tax of 075 three-quarters of one percent or.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Massachusetts doesnt have local sales tax rates only a statewide tax rate of 625. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Sales of meals to Harvard faculty and staff are taxable. A Haverhill Massachusetts Meals Tax Restaurant Tax can only be obtained through an authorized.

Bier Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. This page describes the.

Sales of meals to Harvard students are tax-exempt if. The Commonwealth of Massachusetts allowed municipalities to levy this 075 percent tax in an addition to the state-levied 625 percent meals tax in order to help offset. Please enable JavaScript to view the page content.

The meals tax rate is 625. Meals are sold by. Massachusetts local sales tax on meals.

How to pay meal tax in mass Tuesday May 3 2022 Edit. So you would simply charge the state sales tax rate of 625 to buyers in. After a few seconds you will be provided with a full.

The meals tax rate is. Your support ID is. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Please enable JavaScript to view the page content. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Your support ID is.

On a 100 restaurant check a customer would pay an extra 75 cents.

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

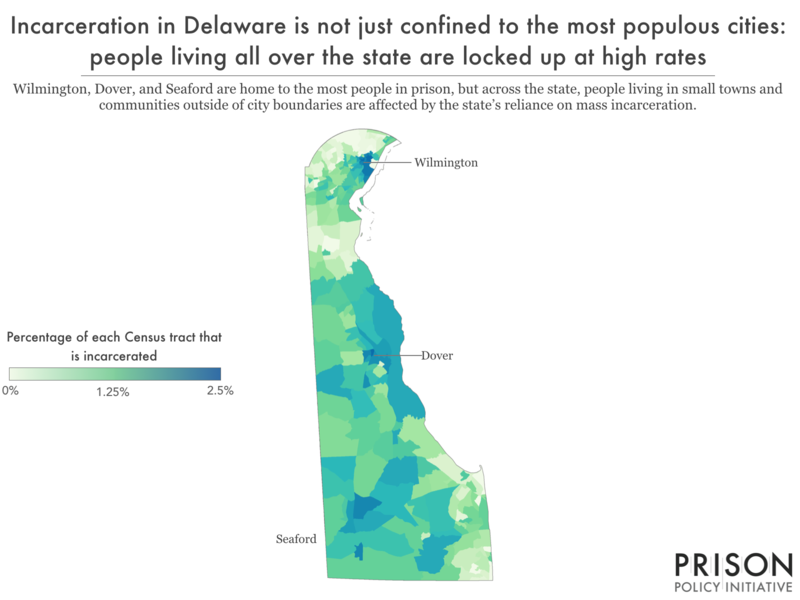

A Framework To Quantify Mass Flow And Assess Food Loss And Waste In The Us Food Supply Chain Communications Earth Environment

Massachusetts Income Tax Calculator Smartasset

Massachusetts Senate Approves 250 Stimulus Checks For Bay Staters Tax Relief For Renters And Low Income Residents Masslive Com

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

The Psychology Of Totalitarianism Desmet Mattias 9781645021728 Books Amazon Ca

Sales Tax By State Is Saas Taxable Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Tax Free Weekend August 13 14 2022 Mass Gov

Massachusetts Sales Tax Handbook 2022

Online Bill Payments City Of Revere Massachusetts

Survey Finds Solid Support For Millionaires Tax Among Would Be Voters The Boston Globe